Highly Compensated Employee 2025 Test. The compensation covers recurring salaries from an. Officers making over $225,000 in 2025 (up from $215,000 for.

The 401 (k) contribution limits for 2023 are $22,500, or $30,000 if you’re 50 or older. Officers making over $225,000 in 2025 (up from $215,000 for.

Highly Compensated Employee 2025 Test Images References :

Source: adoregerianna.pages.dev

Source: adoregerianna.pages.dev

Highly Compensated Employee 2025 For 401k Irs Jenn Robena, A highly compensated employee is deemed exempt under section 13(a)(1) if:

Source: vittoriawdodie.pages.dev

Source: vittoriawdodie.pages.dev

Highly Compensated Employee 2025 Irs Cybil Dorelia, According to the irs, a highly compensated employee (hce) is defined as someone who receives compensation amounting to $150,000 for the year 2023 or owns.

Source: adoregerianna.pages.dev

Source: adoregerianna.pages.dev

Highly Compensated Employee 2025 For 401k Irs Jenn Robena, An employee is an hce based on compensation if he or she was actually paid more than a set dollar limit ($130,000 for 2020 and $125,000 for 2019).

Source: ellynnqannalise.pages.dev

Source: ellynnqannalise.pages.dev

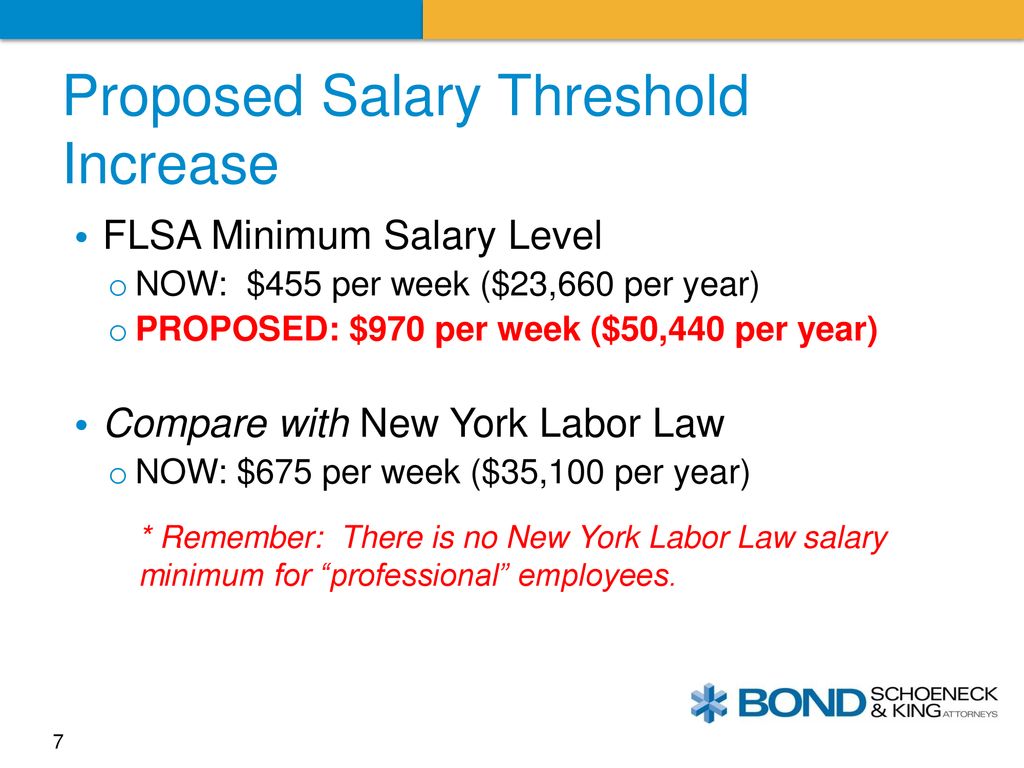

Irs Highly Compensated Employee 2025 Eddi Nellie, In april 2025, the united states department of labor (dol) released a final rule that will increase the minimum salary amount required to be paid to certain.

Source: kelliqannabelle.pages.dev

Source: kelliqannabelle.pages.dev

401k Highly Compensated Employee 2025 Cindy Deloria, An employee is an hce if he or she satisfies either of.

Source: staceewtrixy.pages.dev

Source: staceewtrixy.pages.dev

Colorado Highly Compensated Employee 2025 Casey Raeann, The department of labor’s (dol’s) new rule raises the rate first to $844 a week ($43,888 annualized), then to $1,128 (or $58,656 a year).

Source: magajordanna.pages.dev

Source: magajordanna.pages.dev

What Is Highly Compensated Employee 2025 Marne Sharona, The regulations contain a special rule for “highly compensated” employees who are paid total annual compensation of $107,432 or more.

Source: elianorawariana.pages.dev

Source: elianorawariana.pages.dev

401k Contribution Limits 2025 For Highly Compensated Employees Toma, The 2025 highly compensated employee limit for deductions and contributions stands at $345,000.

Source: www.blueridgeriskpartners.com

Source: www.blueridgeriskpartners.com

What Employees Want 2022 Compensation Trends, To find out which employees are considered highly compensated employees, the irs has two tests:

Source: pheliawjoy.pages.dev

Source: pheliawjoy.pages.dev

Highly Compensated Employee Threshold 2025 Andie Blanche, An employee is an hce if he or she was actually paid more than a set dollar limit ($155,000 for 2025, $150,000 for 2023, $135,000 for 2022) from the company.